ONGC: Share Price Target From [2025 To 2050]

Are you a full time or part time investor who has been consistently trading but getting no results and on the flipside lost more money on the stock market ..!

You might be wondering why I ask this..the problem is you might be missing out the important deal that most people failed to notice.

At the time of i writing ONGC share price surges about 5%..after rating upgrade from CLSA sound promising..right?

You might added ONGC in your watchlist and put your all efforts and invested good amount of money for a great exit right.However,if you getting stuck at your stock selection,you’re not using the correct way to analysing the share price target of the stock like ONDC in the upcoming years.

In this article,we’ll guide you on how to predict the share price of ONGC in the year 2025,2030,2035,2040 and 2050.

We will also cover how ONGC will perform in future. What are the key metrics for analysing the stock in addition to the stock price forecast? Before we do that, let’s examine how oil and natural gas corporations contribute to India’s energy sector.

ONGC:Overview

The Oil and Natural Gas Corporation is the Largest and foremost crude oil and natural gas company under India which comes under the Ministry of Petroleum.

The company Headquarter situated in new delhi,Over the past year under the leadership of ONGC india has become a largest oil and natural gas consumer in the world.The company was established under government of india in august 1956.

ONGC Share Price Target

ONGC, the energy provider and giant of India, is showing great surge in the recent market. The company’s share price is reflecting its dominance in India’s oil and gas sector with strong fundamentals supporting its growth.

Let’s see what’s driving ONGC’s market and what investors can expect in coming years.

| Year | Minimum | Maximum |

| 2025 | 230 | 313 |

| 2026 | 385 | 420 |

| 2027 | 415 | 526 |

| 2028 | 430 | 512 |

| 2029 | 537 | 540 |

| 2030 | 550 | 567.65 |

| 2040 | 950 | 1080 |

| 2050 | 1200 | 1500 |

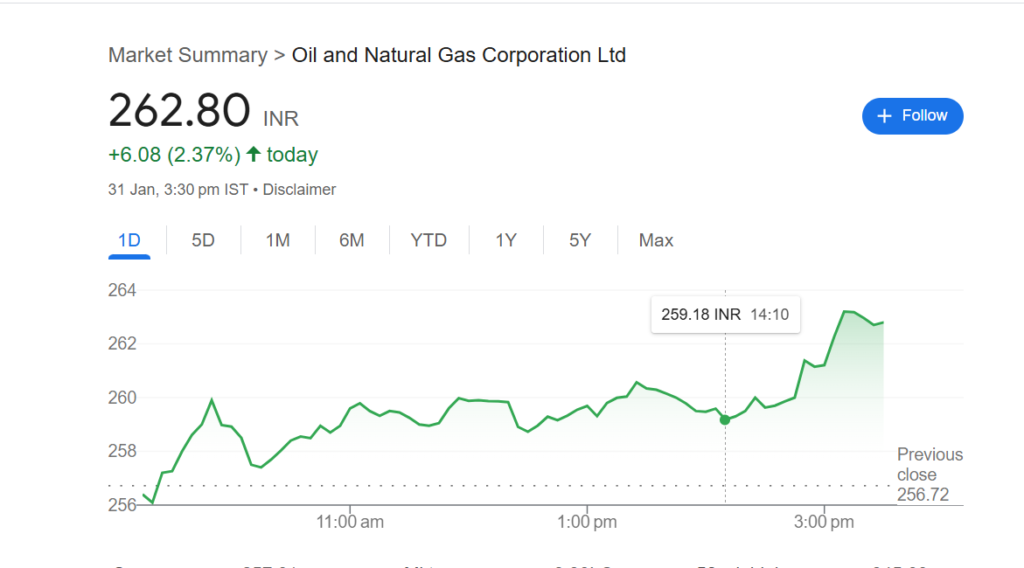

ONGC Share Price Chart

Technical indicators are showing ONGC’s share price is moving up. Key support levels are established at recent price points and resistance levels are indicating more up move. Stock’s pattern is showing increasing confidence of investors in the company’s future.

Current Financial Metrics For ONGC Share Price

Here is updated financial metrics of ONDC

- Open Price: ₹145.50

- Previous Close: ₹146.15

- High Price: ₹146.50

- Low Price: ₹142.35

- Volume: 7,105,000 shares

- Upper Circuit Limit (UC Limit): ₹160.80

- Lower Circuit Limit (LC Limit): ₹131.50

- VWAP: ₹143.78

- P/E Ratio: 6.20

- Dividend Yield: 5.35%

- 52-week High: ₹190.00

- 52-week Low: ₹119.00

- Market Capitalization: ₹1.91 Lakh Crore

- Face Value: ₹5

ONGC Share Price Target Tomorrow From 2025 To 2050

Looking ahead to 2025 ONGC’s share price target is looking good.

ONGC Ltd Share Price Target 2025

The ONGC share price target by the year 2025 is -313 with steady increases. Ensuring that steady crude oil price and finding useful resources for crude oil.

- Domestic energy demand increasing

- Government’s energy security initiatives

- Operational efficiency improvement

- Fuel manufacturing and mining.

ONGC Ltd Share Price Target 2030

The Ongc Share price target expected to reach 567.65 by the year 2030 with support from growth of increased domestic production of crude oil.We expected domestic grown companies that use crude as raw material will continues to grow

- Exploration for new crude oil sources

- Strategic partnership ship opec countries.

- Exploration for carbon neutral fuels.

- Price bargains with oil producers and domestic companies.

- Use rupee as an alternative instead of petro dollar

ONGC Ltd Share Price Target 2035

The ongc share price target will reach 780 by the year 2035 with a boom in consumption of oil based products like paint,jet fuel,cosmetics and various cleaning equipment.

- Strategic investments in renewable sector

- Expend energy portfolio

- Increasing ev vehicles

- Expecting new energy distributors for meet increasing demand

ONGC Ltd Share Price Target 2040

The ONGC share price target will reach 1080 by the year 2040.The ONGC will strengthen the oil distribution chain and give new regulatory changes that will benefit consumers like us.

- Exploration of new locations for refineries.

- Increasing use of renewable energy resources.

- Improving operational efficiency.

ONGC Ltd Share Price Target 2050

In 2030 ,Target for ONGC will be 1500.Economic growth of india the steady government body and market demand and population growth will contribute to achieve this number.

- Renewable energy investments

- Natural gas infrastructure expansion

- Digital transformation benefits

Shareholding Pattern For ONGC Share Price

Who owns ONGC shares? Understanding this will give us an idea of the stock’s stability:

- Promoters: 60.41%

- Retail and Others: 21.34%

- FII (Foreign Institutional Investors): 7.75%

- Mutual Funds: 2.92%

- DII (Domestic Institutional Investors): 5.35%

Government Holding: 58.89%

- Policy support

- Direction

- Market confidence

Institutional Investors: 32.11%

- Professional investor confidence

- Stock stability

- Long term growth

ONGC Annual Result

ONGC’s financials are strong with consistent performance:

Revenue Growth

- 15-20% year on year

- Good operating margins

- Cash flow generation

Profit Metrics

- Stable profit margins

- Dividend payments

- Growth indicators

Challenges For ONGC Share Price

Crude Oil Price Volatility

Oil price is both an opportunity and risk for us.

- Impact on profit margins

- Impact on investment decisions

- Impact on stock sentiment

Regulatory Risks

Government policies can affect operations of oil and natural corporations.

- Environmental regulations

- Price controls

- Subsidy mechanisms

Increasing Operating Costs

Cost management is key for every company

- Infrastructure maintenance cost

- Exploration investment

- Technology upgradation

Global Economic Uncertainty

External factors affecting share price:

- International market

- Energy transition

- Geopolitical developments

IS ONDC A Good Buy?

Bull Case (Why to Buy ONGC)

- Market Leader: India’s largest oil & gas producer.

- High Dividend: 4.65% yield.

- Essential Commodities: Oil & gas are always in demand.

- Government Backed: State owned and government supported.

- Diversification: Exploring solar/wind for future.

Bear Case (Why to be cautious)

- Oil Price Volatility: Prone to crude price fluctuations.

- Government Intervention: Regulatory pricing pressures.

- High Debt: Debt is a constraint on growth and dividend.

- External Risks: Regulatory headwinds.

- Competition: Slow pace of transition.

ONGC has a good future ahead despite these challenges. Investors should consider the company’s strong market position and risks while investing. Do research and know your investment goals before investing.

You can read more about LIC housing here

One Comment