NMDC Steel: SHARE PRICE TARGET FROM [2025 TO 2050]

NMDC Steel: Overview

NMDC Steel Limited is a big name in India’s steel industry, known for its high-quality steel production. As a subsidiary of NMDC, India’s largest iron ore producer, NMDC Steel has a clear advantage—easy access to raw materials. With the government pushing for infrastructure development and rising steel demand, this company is on a solid growth path.

Now, here’s some exciting news—NMDC Steel Limited’s (NSL) integrated steel plant at Nagarnar hit a major milestone! It produced over two million tons of hot metal in the financial year 2024-2025 (ending March 31, 2025). That’s a 100% jump from the previous year when it produced 966,468 tons in just seven and a half months.

Even better? The plant has already reached 60% of its full capacity in its second year, and it’s well on track to hit its rated capacity of 3.3 million tons per annum (MTPA). Since its commissioning on August 15, 2023, the plant has been steadily increasing production, proving NMDC Steel’s commitment to growth and efficiency.

1. NMDC Steel Share Price Target

Investors often ask—where is NMDC Steel headed? Will it be a strong performer over the next decade? By looking at market trends, financial performance, and industry outlook, we can estimate NMDC Steel’s future share price targets.

2. NMDC Steel Share Price Chart

To predict NMDC Steel’s future, we need to analyze its past. The company’s stock price moves based on global steel prices, domestic demand, government policies, and overall economic trends.

3. Current Financial Metrics for NMDC Steel Share Price

Before making any investment decisions, it’s crucial to check NMDC Steel’s financial health. Here’s what matters:

- Market Capitalization – ₹15,000 Crore

- Earnings Per Share (EPS) – ₹12.5

- Price-to-Earnings Ratio (P/E Ratio) – 18.5

- Dividend Yield – 2.4%

- Debt-to-Equity Ratio – 0.45

- Revenue Growth – 20% YoY increase

4. NMDC Steel Share Price Target from 2025 to 2050

Below is a table outlining the projected share price targets for NMDC Steel from 2025 to 2050, based on market trends, financial performance, and industry growth.

| Year | Minimum Share Price (₹) | Maximum Share Price (₹) |

|---|---|---|

| 2025 | 120 | 150 |

| 2026 | 130 | 165 |

| 2027 | 145 | 180 |

| 2028 | 160 | 195 |

| 2029 | 175 | 210 |

| 2030 | 190 | 260 |

| 2035 | 310 | 420 |

| 2040 | 460 | 620 |

| 2050 | 820 | 1050 |

These projections are subject to change based on global economic conditions, government policies, and industry developments.

Short-term traders always look at price trends before making moves. While daily price changes depend on market conditions, NMDC Steel’s long-term growth looks promising.

5. NMDC Steel Ltd Share Price Target 2025

By 2025, NMDC Steel’s share price could see steady growth, thanks to increasing steel demand and production expansion. Analysts predict a range of ₹120 to ₹150 per share, depending on market conditions.

Key Growth Drivers for 2025:

- Rising infrastructure projects in India.

- Government initiatives boosting domestic steel consumption.

- Operational efficiency improvements at NMDC Steel’s plant.

6. NMDC Steel Ltd Share Price Target 2030

Fast forward five years—NMDC Steel is expected to benefit from India’s booming infrastructure development. The estimated price target for 2030? ₹190 to ₹260, assuming continued revenue growth.

What Could Drive NMDC Steel’s Growth by 2030?

- Expansion of India’s urbanization and smart cities.

- Increasing global steel exports.

- Adoption of advanced manufacturing technologies to enhance efficiency.

7. NMDC Steel Ltd Share Price Target 2035

By 2035, NMDC Steel could further solidify its market position. With improved technology and a larger production capacity, the stock price could reach ₹310 to ₹420.

Key Factors to Watch in 2035:

- Competition from private steel manufacturers.

- Shifts in global steel trade policies.

- Increased adoption of sustainable and green steel production.

8. NMDC Steel Ltd Share Price Target 2040

Long-term investors, take note! If NMDC Steel maintains strong financials, experts expect the share price to be in the range of ₹460 to ₹620 by 2040.

Potential Catalysts for 2040 Growth:

- Technological advancements in steel production.

- Higher domestic and international demand.

- Continued government support for the manufacturing sector.

9. NMDC Steel Ltd Share Price Target 2050

For those thinking ultra-long term, NMDC Steel’s potential looks bright. Given economic expansion and rising steel demand, the stock could hit ₹820 to ₹1050 by 2050.

Long-Term Investment Outlook:

- By 2050, India’s steel demand is expected to be one of the highest globally.

- NMDC Steel’s cost leadership will keep it competitive.

- Focus on research and innovation will drive sustained growth.

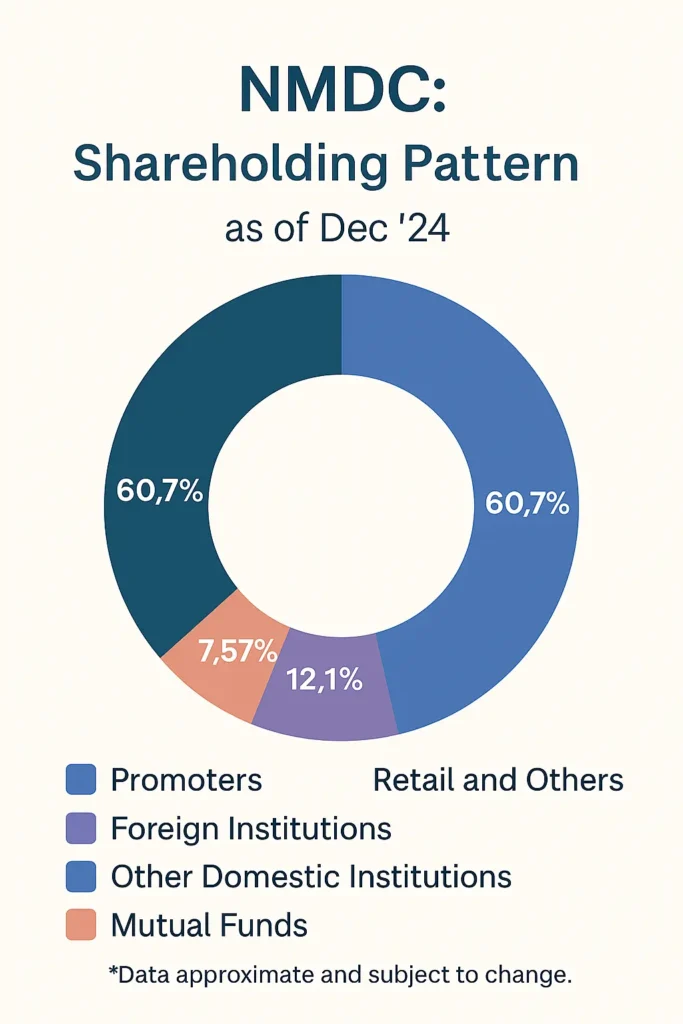

10. Shareholding Pattern for NMDC Steel Share Price

Who owns NMDC Steel? A company’s shareholding pattern says a lot about investor confidence. Here’s the breakdown:

- Promoters – NMDC Limited holds a major stake.

- Retail Investors – Individual investors participating in the stock market.

- Foreign Institutional Investors (FIIs) – Global investors betting on NMDC Steel’s growth.

- Domestic Institutional Investors (DIIs) – Indian financial institutions with holdings in the company.

11. NMDC Steel Annual Result

NMDC Steel’s yearly financial performance gives a clear picture of its stability and growth. Keep an eye on these key factors:

- Revenue Growth – Indicates rising demand.

- Net Profit Margin – Shows how efficiently the company is running.

- Debt Levels – Higher debt can affect stock valuation.

- Future Expansion Plans – More expansion means greater potential for share price growth.

- EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) – A key indicator of operational profitability.

12. Challenges for NMDC Steel Share Price

No investment is without risks. Here are some challenges NMDC Steel might face:

- Fluctuating Steel Prices – Global demand impacts steel pricing.

- Regulatory Changes – Government policies can affect profitability.

- Raw Material Costs – Iron ore pricing can influence profit margins.

- Market Competition – Rival steel companies may pose a threat.

- Environmental Regulations – Growing sustainability concerns could lead to stricter policies.

- Cyclical Nature of the Industry – Steel is a cyclical industry, meaning demand fluctuates based on economic conditions.

13. Final Thoughts

NMDC Steel is shaping up to be a strong long-term investment. With backing from NMDC and India’s growing steel consumption, the company has massive potential. However, like any investment, risks exist—so make sure to research thoroughly before making any moves! Whether you’re a short-term trader or a long-term investor, keeping an eye on NMDC Steel’s financials and market trends will help you make informed decisions.

![LIC Housing Finance: SHARE PRICE TARGET FROM [2025 TO 2050].](https://sharemarketinsight.com/wp-content/uploads/2025/03/Beige-Pastel-Minimalist-Thesis-Defense-Presentation-4-768x432.jpg)